Author Archive

WORKPLACES RETURN, BUT NOT HOME YET

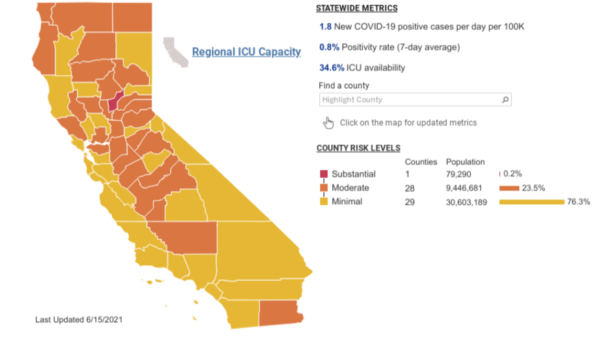

On June 15, Governor Newson has terminated the March, 2020 “stay at home” and May, 2020 “blueprint for safer economy” executive orders that had imposed an all-county tier severity system for physical distancing, business capacity, and other limitations.

PROVE IT

California employers must provide each not-exempt-from-overtime employee off-duty rest breaks based on the number of hours that employee works in a given day. An employer who fails to do so must pay the worker one additional hour of pay (i.e., premium pay) in that employee’s next paycheck.

CALIFORNIA SUMMER MINIMUM WAGE RATE INCREASES

California minimum wage is currently $14.00/hour for larger employers (26 or more employees) and $13.00/hour for employers with 25 or fewer. The final 2016 Senate Bill (SB) 3 increase to $15.00/hour will occur on January 1, 2022 for larger employers and January 1, 2023 for the rest.

MANDATORY OPTIONS FOR RETIREMENT FUNDING

To level the playing field for those without access to workplace-based retirement plans, California is phasing in employer requirements to either: ● offer a retirement savings vehicle such as a 401(k) plan; or ● facilitate employee access to CalSavers, a state-run savings program in the form of an automatic payroll deduction Roth IRA.

PLEASE: DOCUMENT WORKPLACE MEAL BREAKS

With certain exceptions for specific industries, occupations, and limited situations, California Labor Code 512 and the Industrial Wage Commission Wage Orders require employers to provide non-exempt employees with a minimum 30-minute off-duty meal break starting before the end of the fifth hour of work.

PLAY PAY

With Memorial Day and July 4 approaching, California employers should review and, as needed, update their written holiday policies.

California law does not require employers to provide or to pay for holiday time off.

GOOD WORKPLACE POLICY IS BOSS

Clear, written workplace policies are critical components for workplace legal compliance and productivity. The volatile combination of COVID’s impact on workplace management and California’s lawsuit-prone reputation underscore the preventative importance of such written rules and protocols.

CALIFORNIA PAID VACATION CAN BE NO HOLIDAY

California businesses do not have to offer workers paid vacations. However, the Labor Code dictates that if implemented, such pay is an accrued or accruing benefit, prohibiting a “use it or lose it” plan.

WORKPLACE INCOMPETENCE: NOT A CIVIL RIGHT

Wisely, the federal and California workplace anti-discrimination protections do not include ineffectiveness, ineptness, uselessness, or incompetence.

CAUTIONARY TALE EPISODE 42 THE PAGA MONSTER IS HUNGRY

Employees’ attorneys are increasingly relying on the California Private Attorney General Act (PAGA) to pursue businesses for Labor Code violations.