Archive for the ‘Employee vs. Independent Contractor Status’ Category

WHAT’S NEW IN 2021 CALIFORNIA’S NEWEST INDEPENDENT CONTRACTOR LAW PART 5

New “Music and Entertainer” Exemption from the Strict “ABC” Test In response to more than a year of meetings, fact-findings and discussions between legislators and the music industry, AB 2257 and new Labor Code 2780, effective September 4, 2020, provide a new music and entertainment industry exemption from the strict “ABC” test for independent contractor classification. Now eligible to […]

WHAT’S NEW IN 2021 CALIFORNIA’S NEWEST INDEPENDENT CONTRACTOR LAW PART 3

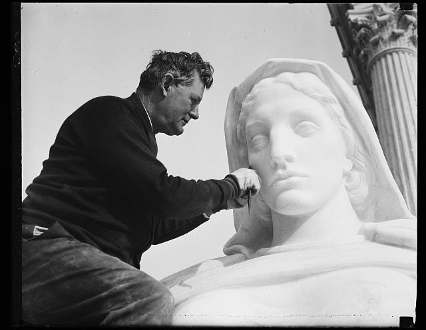

“Fine Artists” and Other Clarified and Expanded Professional Services Exemptions Out of Sacramento’s political process has come passage of AB 2257 and new Labor Code 2778, effective September 4, 2020, providing a broader list of professional services exemptions from the rigid “ABC” test for independent contractor classification. See, Bullet Dodging Part 2 – California’s “Professional Services” […]

WHAT’S NEW IN 2021 CALIFORNIA’S NEWEST INDEPENDENT CONTRACTOR LAW PART 2

Revised Referral Agency Exception Effective September 4, 2020, Assembly Bill (AB) 2257 and Labor Code section 2777 broaden the “referral agency” exception to the state’s strict “ABC” definition of independent contractors. A referral agency is a “business that provides clients with referrals for service providers to provide services under a contract,” other than the specific […]

WHAT’S NEW IN 2021 CALIFORNIA’S NEWEST INDEPENDENT CONTRACTOR LAW PART I

Revamped Business-To-Business Exceptions Effective September 4, 2020, Assembly Bill (AB) 2257– through Labor Code section 2776 – modifies and expands exemptions for bona fide business-to-business contracting relationships from the severe ABC independent contractor test. The more-forgiving Borello multi-factor balancing test will continue determine contractor vs. employee status for such associations. A business entity providing services […]

GAGGING THE GIGS, PLAN B

California Remodels Exceptions to Its Strict Independent Contractor Test Beginning with the California Supreme Court’s Dynamex Operations West, Inc. v. Superior Court decision (April, 2018) and continuing with the passage of AB 5, effective January 1, 2020, state policymakers have sought to limit the definition of “independent contractors” under a severe ABC test. The trend […]

BACK FROM THE BRINK – FOR NOW

Uber and Lyft’s Last-Minute Reprieve From Order to Convert Drivers to Employees As a San Francisco judge had directed that Uber and Lyft convert their drivers to employees by August 21, 2020, the rideshare giants were ready to shut down their California operations unless the Court of Appeal put that order on hold. See, Traffic […]

TRAFFIC SLAMMING

New Fronts on California’s War Against Uber and Lyft Uber and Lyft have successfully battled suits seeking to prevent the companies from classifying their drivers as independent contractors, until now. On August 10 – in a misclassification action pending in San Francisco – the court issued a preliminary injunction requiring Uber and Lyft to convert […]

CAUTIONARY TALE EPISODE 36 IS GIG UP FOR CAR WASH COMPANY?

First AB 5 Suit Challenging Independent Contractor Classification The California Labor Commissioner has filed her “AB 5” first lawsuit — against Mobile Wash, Inc. of Bellflower, CA — for misclassifying more than 100 mobile car washers as independent contractors under the state’s “ABC” test. See, The Mystery of it All – Employed or Independent? California Offers […]

CALLING OUT BIG GIG

California Wants Uber and Lyft Drivers as Employees It seemed like a good idea at the time: the rapid growth of Uber-style “gig economy” business models ostensibly offering a win-win of worker freedom and consumer convenience. Yet, California government came to another conception of such arrangements: presumed exploitation. Hence enter AB 5 and its hardball […]

ROADKILL

Federal Court Denies Uber Request to Stop AB5 In a blow to the gig economy, a Los Angeles federal court has ruled that Uber, Postmates and two individual plaintiffs are unlikely to succeed on their constitutional challenges to AB5. Olson v. State of California (Olson). While noting the potential harm Uber and the other plaintiffs […]