Archive for the ‘Employee vs. Independent Contractor Status’ Category

YOU SNOOZE, YOU LOSE

Time Is Running Out for Caregiver Agencies to Meet July 1, 2016 Licensing Deadline The Home Care Services Consumer Protection Act (HCOCPA) requires Home Care Organizations (HCO) to receive a license from the California Department of Social Services (CDSS) by July 1, 2016. Health & Safety Code 1796.61(b) and (c). The law mandated that HCOs […]

CALIFORNIA LABOR LAWS 2016

Caregiver Agencies Must File License and Caregiver Registration Applications by March 1, 2016 or Cease Operation Our recent article “Caregiver Agencies Must Comply with Home Care Services Consumer Protection Act or Cease Operation” provided an overview of this new California law, effective January 1, 2016. The Act defines “home care organizations” (HCOs) as any individual, […]

NEW CALIFORNIA LAWS 2016

Piece Work Compensation Is a Wreck Waiting to Happen The Perils of New Labor Code Section 226.2 for Trucking, Auto Repair and Other Industries “Piece work” compensation or “piece rate” is payment for work based on production. For decades, this method has worked to benefit worker and management in many industries. It has become common […]

CALIFORNIA LAW PROTECTS UNDOCUMENTED EMPLOYEES FROM WORKPLACE DISCRIMINATION

As we have described in California’s Expanded Immigration-Related Protections and California Extends Protections for Whistleblowing Employees, several California laws protect employees, regardless of undocumented status, from actual or threatened retaliation for demanding workplace rights. These state protections of immigrant workers, some of the strongest nationwide, would seem at odds with the federal law (Title 8, […]

CALIFORNIA LABOR LAWS 2015 UNFAIR IMMIGRATION-RELATED PRACTICES

California Extends Protections For Whistleblowing Employees As relayed a year ago in California’s Expanded Immigration-Related Protections, this state provides the most stringent retaliation protections for immigrant workers in the country. Effective January 1, 2015, California employer obligations in this area are increased again. Labor Code section 1019 has prohibited any California business from engaging in […]

CALIFORNIA LABOR LAWS 2015 NEW REQUIREMENT FOR COMPUTER PROFESSIONAL OVERTIME EXEMPTION

Minimum Hourly Pay Rate to Increase January 1, 2015 California Labor Code section 515.5 exempts certain employees in the computer software field from overtime compensation. The criteria include set minimum compensation. The California Department of Industrial Relations (DIR) recently increased this minimum, effective January 1, 2015. To comply with the section 515.5 exemption, California employers will […]

CLASSIFYING WORKERS, EMPLOYEES OR INDEPENDENT CONTRACTORS?

New Court Decision on Delivery Drivers Shows the Issue Requires Detailed Analysis The dividing line between properly classified employees and independently contracted workers can often be about as clear as mud. The June, 2014 decision from the federal Ninth Circuit Court of Appeals in Ruiz v. Affinity Logistics Corp illustrates the perils of a company’s […]

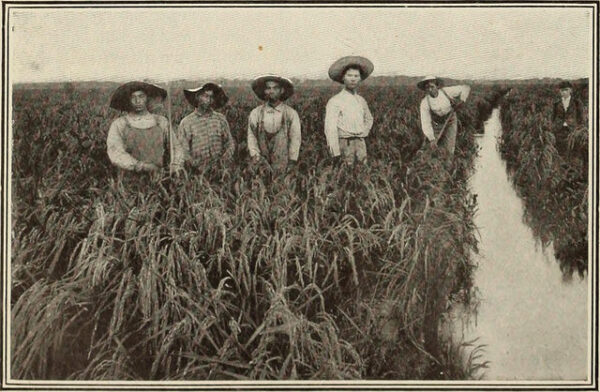

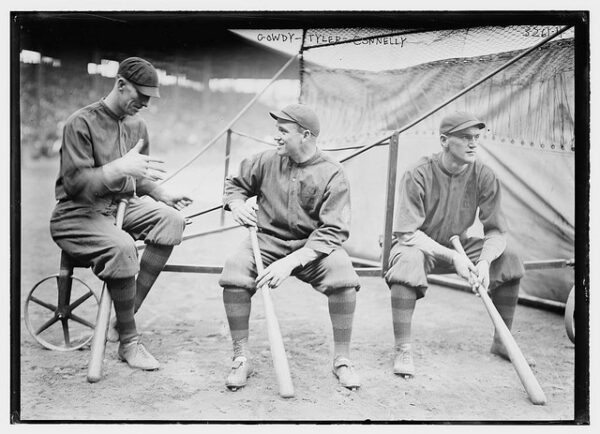

MINOR LEAGUE PLAYERS CHALLENGE BASEBALL’S LABOR PRACTICES

Underpayment of Minimum Wage and Overtime Is Foul Play Thirty-three former minor league ball players seek to pull back the curtain on alleged system-wide violations of minimum wage or overtime. Their federal class action suit challenges Commissioner Bud Selig, the Office of the Commissioner, and, in effect, every baseball team in the country to remedy […]

INDEPENDENT OR EMPLOYED?

Classifying Workers Correctly is a Case-by-Case Challenge There are economic risks for an employer who misclassifies a worker who should be employed as an independent contractor. A wide range of California and federal agencies have the power to impose back taxes, interest and penalties upon companies who unsuccessfully attempt the tactic. California placed greater deterrents […]

PRIVATE HOUSEHOLD WORKERS IN CALIFORNIA

Special Overtime and “Room and Board” Rules Apply On our article “Caring for Caregivers,” a recent visitor to our website asked: “How much is housing and meal value [in my area] for a private household worker under California Wage Order 15?” As in every area of employment law, the answer of course depends on the […]