Archive for the ‘Uncategorized’ Category

EASY DOES IT – TAKE TWO

Last November, Cal/OSHA required nearly all employers to implement an effective written COVID-19 Prevention Program (Model CPP) pursuant to mandatory emergency temporary standards (ETS).

On June 29 2021, Cal/OSHA published its revised Model CPP to comport with the newest June 17, 2021 ETS revisions.

DON’T HIDE THE BALL

California requires employers to provide an accurate, itemized statement with each wage payment or twice monthly. Labor Code 226(a) specifies wage statement contents, such as ● employer’s name and address; ● employee’s name; ● last four digits of employee’s social security number or other suitable identifying number; ● hours worked; ● pay rates; and ● gross and net wages earned.

YOU’RE GETTING HOTTER

As outdoor temperatures rise, employers must implement and monitor heat illness protection standards. For example, employers must ●track the weather and check for approaching heat waves; ●provide shade when the temperature reaches 80 degrees; and ●implement additional high-heat procedures when the temperature reaches or exceeds 95 degrees, such as enhanced communication, vigilance and water consumption.

UPDATE CAUTIONARY TALE EPISODE 42A PAGA MONSTER QUELLED … FOR NOW

Under the California Private Attorney General Act (PAGA), current or former employees can sue employers in a “representative” capacity for alleged Labor Code violations. PAGA claims, filed by employees when the state declines to do so, seek civil penalties to be shared 75 percent for the state of California and 25 percent between the plaintiff and other employees.

EASY DOES IT

Last November, Cal/OSHA issued mandatory emergency temporary standards (ETS) to prevent the workplace spread of COVID-19. The standards applied to most California workers not covered by the Aerosol Transmissible Diseases (ATS) standard.

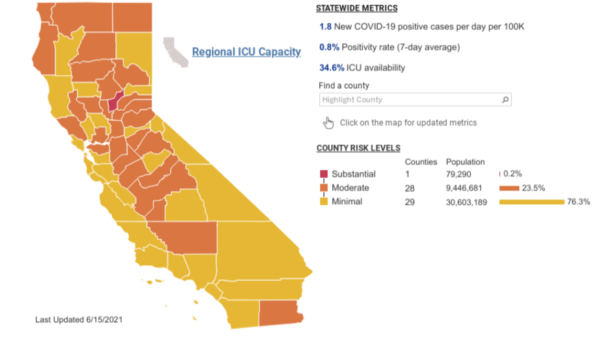

WORKPLACES RETURN, BUT NOT HOME YET

On June 15, Governor Newson has terminated the March, 2020 “stay at home” and May, 2020 “blueprint for safer economy” executive orders that had imposed an all-county tier severity system for physical distancing, business capacity, and other limitations.

PROVE IT

California employers must provide each not-exempt-from-overtime employee off-duty rest breaks based on the number of hours that employee works in a given day. An employer who fails to do so must pay the worker one additional hour of pay (i.e., premium pay) in that employee’s next paycheck.

CALIFORNIA SUMMER MINIMUM WAGE RATE INCREASES

California minimum wage is currently $14.00/hour for larger employers (26 or more employees) and $13.00/hour for employers with 25 or fewer. The final 2016 Senate Bill (SB) 3 increase to $15.00/hour will occur on January 1, 2022 for larger employers and January 1, 2023 for the rest.

MANDATORY OPTIONS FOR RETIREMENT FUNDING

To level the playing field for those without access to workplace-based retirement plans, California is phasing in employer requirements to either: ● offer a retirement savings vehicle such as a 401(k) plan; or ● facilitate employee access to CalSavers, a state-run savings program in the form of an automatic payroll deduction Roth IRA.

PLEASE: DOCUMENT WORKPLACE MEAL BREAKS

With certain exceptions for specific industries, occupations, and limited situations, California Labor Code 512 and the Industrial Wage Commission Wage Orders require employers to provide non-exempt employees with a minimum 30-minute off-duty meal break starting before the end of the fifth hour of work.