Posts Tagged ‘california labor laws’

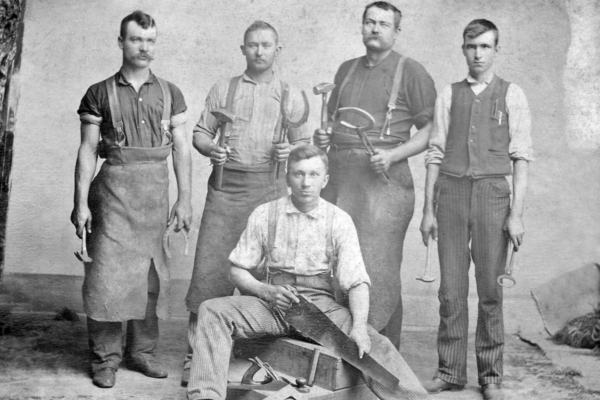

CAUTIONARY TALES EPISODE 29

General Contractor and Property Owners Left Holding Bag Labor Code section 218.7, effective January 1, 2018, made general “direct” contractors (those delivering to property owners directly) responsible for wage payments to employees of subcontractors who fail to make those payments. However, direct contractors may be able to prevent such exposure through well-constructed written agreements with […]

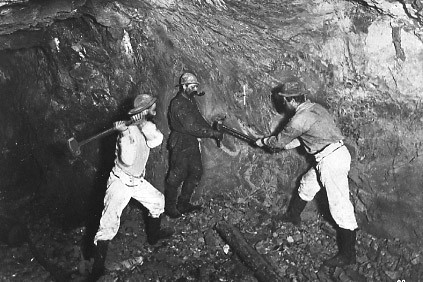

CAUTIONARY TALES EPISODE 28

EEOC Settles Female Miner Discrimination and Retaliation Case For $690,000 The U.S. Equal Employment Opportunity Commission (EEOC) has announced the $690,000 resolution of its gender-based lawsuit against Alaska gold mining outfit Northern Star LLC, formerly Sumitomo Metal Mining Pogo (Pogo). The government alleged Pogo discriminated against female underground miner Hanna Hurst by refusing to promote her despite promoting male […]

BE KIND TO MOMMIES

Pregnancy Discrimination Is a Really Bad Idea Pregnancy remains one of the most clearly protected classifications for employees, safeguarded not only under general disability laws, but also under laws enacted specifically to protect expectant women. See, for example, Pregnancy Accommodation in California (Nov 2018); Employers with 20 or More on Payroll Must Provide Expanded […]

DEALING WITH THE WORKPLACE “DEBBIE DOWNER”

Properly Confronting the Chronically Negative Employee According to Wiktionary.org, a “Debbie Downer” is a “naysayer; one whose negative remarks depress or dissuade others.” Most seasoned managers will be all too familiar with how one negative individual can bring down the entire workforce’s morale. Employers are often reluctant to terminate someone just for a negative attitude, […]

MID-YEAR MINIMUM WAGE RATE INCREASES

Effective July 1, 2019 California minimum wage currently is $12.00 per hour for employers with 26 or more employees and $11.00 for employers that employ 25 or fewer. Annual increases will continue each January 1 until they reach $15.00 per hour in 2022 for larger employers and in 2023 for employers with 25 or fewer employees. […]

INDEPENDENT CONTRACTORS, CALIFORNIA’S ENDANGERED SPECIES

Labor Commissioner Broadens Application of Dynamex Decision In Dynamex Operations West, Inc. v. Superior Court (2018), the California Supreme Court adopted a strict “ABC test” redefining “independent contractor”: The worker is free from the hirer’s control and direction in connection with the performance of the work, both under the contract in fact; The worker performs […]

MAKING DYNAMEX RETROACTIVE

Federal Appeals Court Rules New Independent Contractor ABC Test Applies Before It Existed Industries and employers throughout California have been grappling since April 2018 with the effect of Dynamex Operations West, Inc. v. Superior Court on their independent contractor relationships. Rejecting a multi-factor standard that had been in place since 1989, the California Supreme Court […]

UNIONIZING HOME HEALTH CARE

California May Require More Home Aide Disclosures Starting July 1, 2019 The Home Care Organization Consumer Protection Act (HCOCPA), effective January 1, 2016, requires licensing of home care organizations (HCOs) and registration of their home care aides (HCAs). The Home Care Services Bureau (HCSB) of California’s Department of Social Services (CDSS) regulates this industry. See […]

CAUTIONARY TALES EPISODE 27

Walmart Hit with Six Million Dollar Verdict for “Discouraging” Off-Site Meal Breaks California employers must provide non-overtime-exempt employees unpaid meal break(s) based on the number of hours worked in a given day. See, Required Meal Periods and Rest Breaks Revisited (April, 2018). The California Supreme Court’s 2012 Brinker Restaurant Corp. decision clarified that “employer-provided” breaks […]

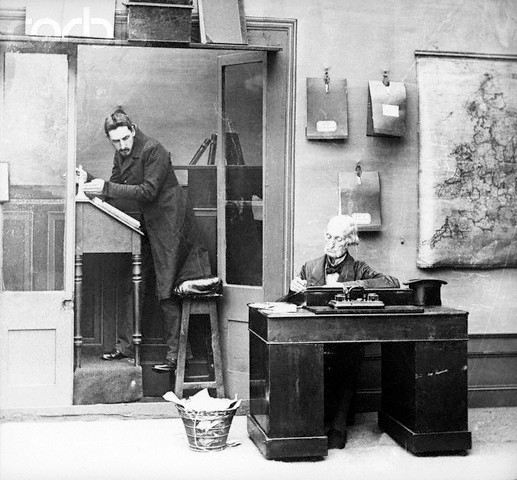

WHAT’S IN A NAME?

Employers Must Heed Pay Stub Technicalities California employers must accurately list specific wage-related information on each worker’s pay stub per pay period, including but not limited to the company’s name and address, total hours worked, wage rate(s), gross and net wages earned, all deductions, and inclusive dates of the pay period. Seemingly, the easiest requirement […]