Posts Tagged ‘wage law’

CAUTIONARY TALES EPISODE 29

General Contractor and Property Owners Left Holding Bag Labor Code section 218.7, effective January 1, 2018, made general “direct” contractors (those delivering to property owners directly) responsible for wage payments to employees of subcontractors who fail to make those payments. However, direct contractors may be able to prevent such exposure through well-constructed written agreements with […]

CAUTIONARY TALES EPISODE 28

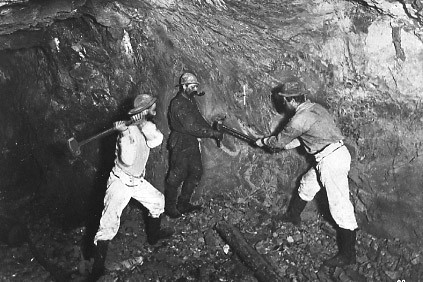

EEOC Settles Female Miner Discrimination and Retaliation Case For $690,000 The U.S. Equal Employment Opportunity Commission (EEOC) has announced the $690,000 resolution of its gender-based lawsuit against Alaska gold mining outfit Northern Star LLC, formerly Sumitomo Metal Mining Pogo (Pogo). The government alleged Pogo discriminated against female underground miner Hanna Hurst by refusing to promote her despite promoting male […]

MID-YEAR MINIMUM WAGE RATE INCREASES

Effective July 1, 2019 California minimum wage currently is $12.00 per hour for employers with 26 or more employees and $11.00 for employers that employ 25 or fewer. Annual increases will continue each January 1 until they reach $15.00 per hour in 2022 for larger employers and in 2023 for employers with 25 or fewer employees. […]

WHAT’S IN A NAME?

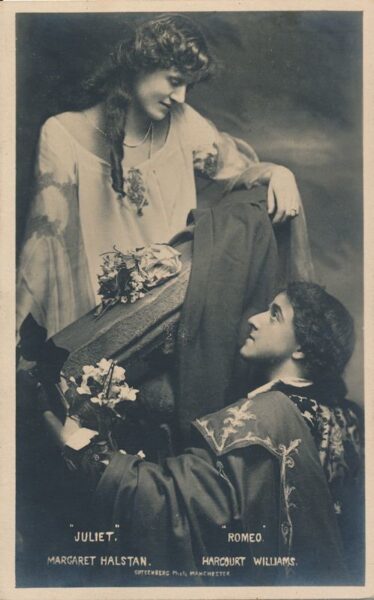

Employers Must Heed Pay Stub Technicalities California employers must accurately list specific wage-related information on each worker’s pay stub per pay period, including but not limited to the company’s name and address, total hours worked, wage rate(s), gross and net wages earned, all deductions, and inclusive dates of the pay period. Seemingly, the easiest requirement […]

CAUTIONARY TALES EPISODE 26

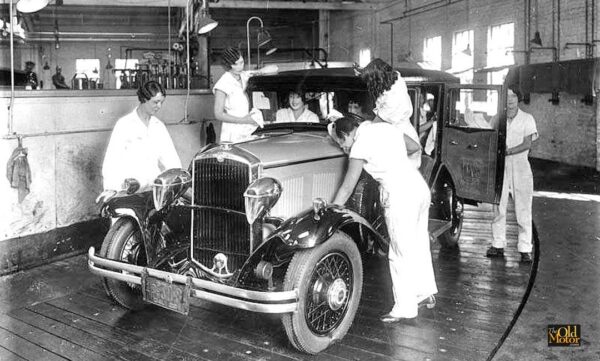

Playa Vista Car Wash Takes a Dunking for $2.36 Million “Wage Theft” On April 17, 2019, the Labor Commissioner’s Office announced a $2.36 million citation — the largest issued against a car wash business to date — against Playa Vista Car Wash along with its president and general manager for failing to properly pay or provide required […]

FOR WHOM THE BELL TOLLS…

KNOCK, KNOCK When It’s Your Turn For a Government Payroll Audit For California, the Employment Development Department (EDD) is responsible for the administration of unemployment and disability insurance, workforce training services and payroll audits. The agency has the power to impose significant, potentially fatal penalties for non-compliance. An EDD visit to look over pay practices […]

ON THE HORIZON

Higher Required Salaries for Managers Nationwide? In 2016, the U.S. Department of Labor (DOL) issued a Final Rule raising the minimum salary amounts to qualify for executives, administrative, professional, outside sales and computer employees overtime exemption under the Fair Labor Standards Act (FLSA). It would have more than doubled the amount that employers had to […]

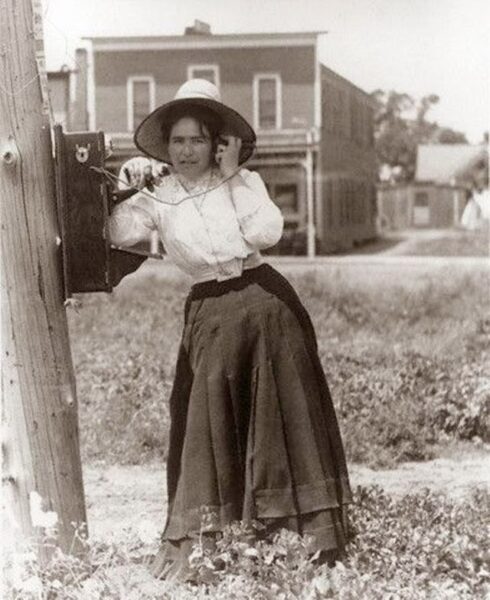

PHONING IT IN

California Employers Must Pay Wages for Required Call-In to Confirm Day’s Work Schedule Employers who require workers to call in to ascertain whether they are needed for a scheduled work shift will now need to rethink this practice. California Industrial Welfare Commission (IWC) publishes “wage orders” containing regulations on wages, breaks, record-keeping and other working […]

WHAT’S NEW FOR 2019 INDUSTRY WAGE ORDERS UPDATED FOR CALIFORNIA MINIMUM WAGE INCREASES

Don’t Forget to Post Your New California Wage Orders California employers must comply with one or more of the 18 California Industrial Welfare Commission’s (IWC) published “wage orders” applicable to their industry or profession. For example, Wage Order 1 applies to the manufacturing industry; Wage Order 4 to professional, technical, clerical, mechanical and similar occupations; […]

CAUTIONARY TALES EPISODE 25 RUBBER CHECKS AND UNPAID WAGES REBOUND ON CONSTRUCTION COMPANY

In another rebuke to the construction industry, the Labor Commissioner has cited RDV Construction, a Los Angeles County subcontractor, $12 million for wage theft violations involving more than a thousand workers. The Carpenters Contractors Cooperation Committee, a non-profit labor-management organization, assisted in bringing those violations to light. RDV provided crews on 35 mixed-use, apartment, and […]