Posts Tagged ‘employee agreements’

THE #METOO MOVEMENT’S IMPACT

EEOC 2018 Report Reflects Increases in Sexual Harassment Charges The U.S. Equal Employment Opportunity Commission (EEOC) has announced the number of workplace discrimination charges filed nationwide during fiscal year 2018 (October 1, 2017 to September 30, 2018). Of the 76,418 discrimination charges filed last year, retaliation topped the list, totaling 39,469 charges, followed by sex, […]

ALL IN THE FAMILY

New Workplace Notice Available For Family Related Leaves Starting April 1, 2019, covered California employers must post the new Family Care and Medical Leave and Pregnancy Disability Leave notice (DFEH-100-21/March 2019). Previously, the notice was only for employers with 50 or more on payroll. It summarized employee rights and responsibilities when requesting Family Care […]

FOR WHOM THE BELL TOLLS…

KNOCK, KNOCK When It’s Your Turn For a Government Payroll Audit For California, the Employment Development Department (EDD) is responsible for the administration of unemployment and disability insurance, workforce training services and payroll audits. The agency has the power to impose significant, potentially fatal penalties for non-compliance. An EDD visit to look over pay practices […]

AIMEE ROSALES IS FIRM’S NEW OFFICE MANAGER

Mrs. Aimee Rosales has been promoted to the position of Office Manager. Her larger role comes after over two years of success as technical assistant for our attorneys. Aimee has extensive executive and administrative experience in the humanitarian non-profit world. We are very pleased to have her take the reins of the firm’s management and […]

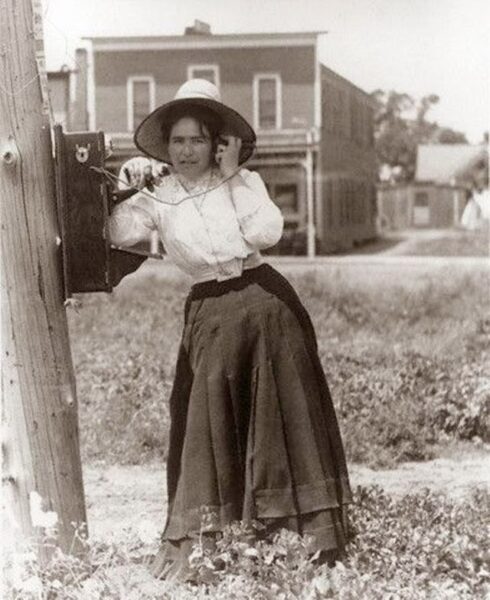

PHONING IT IN

California Employers Must Pay Wages for Required Call-In to Confirm Day’s Work Schedule Employers who require workers to call in to ascertain whether they are needed for a scheduled work shift will now need to rethink this practice. California Industrial Welfare Commission (IWC) publishes “wage orders” containing regulations on wages, breaks, record-keeping and other working […]

WHAT’S NEW FOR 2019 INDUSTRY WAGE ORDERS UPDATED FOR CALIFORNIA MINIMUM WAGE INCREASES

Don’t Forget to Post Your New California Wage Orders California employers must comply with one or more of the 18 California Industrial Welfare Commission’s (IWC) published “wage orders” applicable to their industry or profession. For example, Wage Order 1 applies to the manufacturing industry; Wage Order 4 to professional, technical, clerical, mechanical and similar occupations; […]

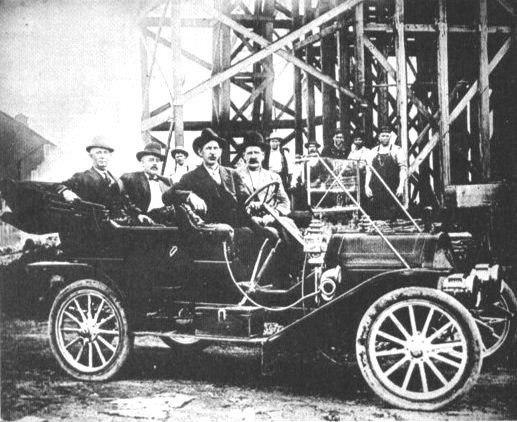

CAUTIONARY TALES EPISODE 25 RUBBER CHECKS AND UNPAID WAGES REBOUND ON CONSTRUCTION COMPANY

In another rebuke to the construction industry, the Labor Commissioner has cited RDV Construction, a Los Angeles County subcontractor, $12 million for wage theft violations involving more than a thousand workers. The Carpenters Contractors Cooperation Committee, a non-profit labor-management organization, assisted in bringing those violations to light. RDV provided crews on 35 mixed-use, apartment, and […]

WHAT’S NEW FOR 2019 CALIFORNIA’S ZERO TOLERANCE PROTECTIONS AGAINST WORKPLACE HARASSMENT

The Expanding Meaning of “Zero Tolerance” The #MeToo movement has prompted the California Legislature to expand employer liability for harassment of employees and other specified persons effective January 1, 2019, making it far easier for workers to sue and bring their cases to trial. Release and Waiver Agreements Prohibited: Except for certain negotiated settlement agreements […]

WHAT’S NEW FOR 2019 PHYSICIANS & SURGEONS NEW 2019 OVERTIME EXEMPTION RATES

California Labor Code section 515.6 exempts certain licensed physicians and surgeons from overtime compensation if they receive set minimum hourly compensation. Effective January 1, 2019, the California Department of Industrial Relations is increasing the minimum from $79.39 to $82.72 per hour, up from $79.39, effective January 1, 2019. To avoid California’s requirements to pay overtime premium […]

WHAT’S NEW FOR 2019 IRS MILEAGE RATE INCREASING 3.5 CENTS EFFECTIVE JANUARY 1, 2019

The Internal Revenue Service (IRS) has announced its 2019 optional standard mileage reimbursement rate for employee business use of a personal vehicle, effective January 1, 2019, increasing from 54.5 cents to 58 cents. The IRS calculates the rate annually based on a study of fixed and variable automotive operating costs, including insurance, repairs, maintenance, gas […]