Posts Tagged ‘employee compensation’

WHAT’S NEW IN 2017

Employers Must Notify All California Workers if Income Tax Credit Congress created the Federal Earned Income Tax Credit (EITC) in 1975 to incentivize low-income workers to seek employment rather than welfare. In 2015, California authorized the “Cal EITC” for the same purposes. The federal and California EITC programs each reduce the amount of tax that […]

WHAT’S NEW FOR 2017

Larger California Employers Must Pay Higher Minimum Wages and Salaries Effective January 1, 2017 For companies with 26 or more on payroll, California Labor Code 1182.12 directs yet another statewide increase in minimum hourly wages, from $10 to $10.50/hour, starting January 1, 2017. Employers with 25 or fewer on payroll must comply with that increase […]

HOT OFF THE PRESSES

Minimum Wage Rates List Updated for 2017 California’s local minimum wage ordinances continue to spread like wildfire. Since publishing our Minimum Wage Rates For 2017 article two weeks ago (December 16, 2016), the City of San Leandro enacted their own minimum wage rates and regulations. This updated 2017 list includes San Leandro’s ordinance as […]

WHAT’S NEW FOR 2017

IRS Lowers Mileage Rate by One-Half Cent to 53.5 The Internal Revenue Service (IRS) has announced a decrease of its optional standard mileage reimbursement rate for an employee’s business miles from 54 cents to 53.5 cents, effective January 1, 2017. The government bases its standard mileage rate on an annual study of fixed and variable […]

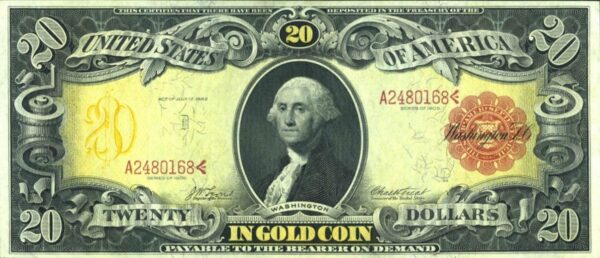

CALIFORNIA INCREASES MINIMUM WAGE RATES FOR 2017

California minimum wage will increase to $10.50 per hour on January 1, 2017 for employers with 26 or more employees (smaller employers will continue to pay $10.00 per hour until January 1, 2018) then increase each year until reaching $15 per hour in 2022. See California’s Gradual Increases in Minimum Wage, to Reach $15.00 Per […]

CALIFORNIA REVISES OVERTIME-EXEMPT MINIMUM HOURLY RATES

For Computer Professionals and M.D.s Effective January 1, 2017 California Labor Code sections 515.5 and 515.6 exempt certain computer software professionals and licensed physicians and surgeons from overtime compensation as long as they receive at least certain specified minimum hourly rates of pay. As we recently covered in Overtime – Exempt Physicians and Surgeons Minimum […]

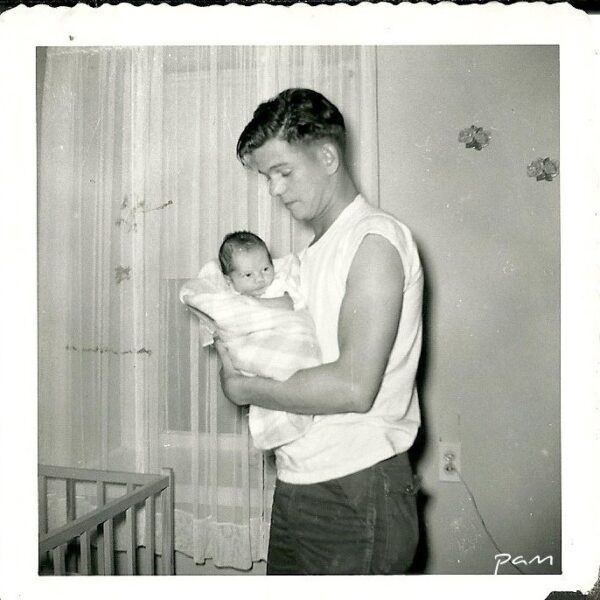

PAID PARENTAL LEAVE REQUIRED FOR SAN FRANCISCO EMPLOYERS

Groundbreaking Law Creates Paid Time Off for Baby Bonding As part of their ongoing efforts to establish family-friendly workplaces, the City and County of San Francisco are now the first municipalities in the U.S. to require employers to pay for parental leave. The San Francisco Paid Parental Leave Ordinance and its amendment (together, PPLO), starting […]

SUN SETTING ON SAFE HARBOR ON DECEMBER 15, 2016

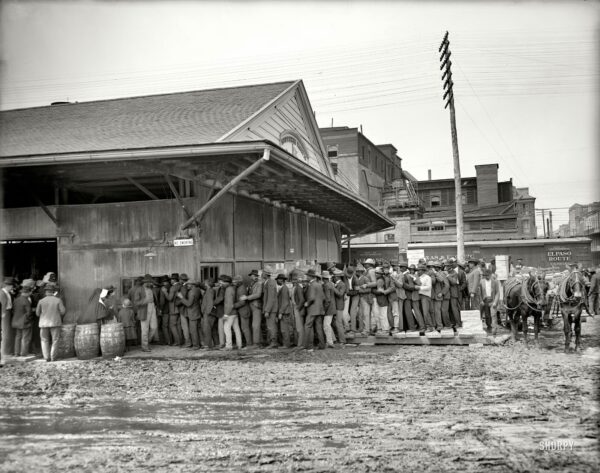

California Piece Pay Employers’ Final Step Is Payment and Documentation Submitted to the State Several California industries – trucking and agriculture in particular – have utilized “piece-rate” pay for many years, commonly to the benefit of management and employees alike. Drivers have earned by the miles traveled or loads delivered, field workers have made their […]

EMPLOYER DUE DILIGENCE REQUIRED TO LOCATE FORMER WORKERS UNDER CALIFORNIA’S PIECE WORK SAFE HARBOR

All Steps Must Be Taken by December 15, 2016 In the few weeks remaining before the mid-December 2016 deadline, thousands of California businesses must complete all required steps to accomplish “safe harbor” protection from potentially significant piece rate back pay liabilities. Specified in Labor Code 226.2(b), These actions include: (1) accurate calculation of the safe […]

NEW CALIFORNIA OVERTIME REQUIREMENTS FOR AGRICULTURAL EMPLOYERS

Phase-In of Stricter Rules Begins January 1, 2017 Agricultural employers in California must prepare to overhaul their compensation schemes under the Phase-In Overtime for Agricultural Workers Act of 2016 (Act), a new law signed by the Governor on September 12, 2016. The Act affects all persons “employed in an agricultural occupation” (essentially field workers), lowering […]