Posts Tagged ‘Employer Rights’

THE MYSTERY OF IT ALL

Lony Chaney, 1920 Employed or Independent? California Offers AB5 Answers The hottest California employment question of late: do independent contractors still exist? The California Supreme Court’s 2018 Dynamex decision turned independent classification on its head, imposing a strict “ABC” contrary to decades of law and custom. The legislature followed suit with Assembly Bill (AB) 5, […]

WHAT’S NEW IN 2020 PHYSICIANS & SURGEONS NEW 2020 OVERTIME EXEMPTION RATES

California Labor Code section 515.6 exempts certain licensed physicians and surgeons from overtime compensation if they receive set minimum hourly compensation. Effective January 1, 2020, the California Department of Industrial Relations is increasing the minimum from $82.72 to $84.79 per hour, effective January 1, 2020. To avoid California’s requirements to pay overtime premium rates after eight hours worked in a day […]

DODGING THE BULLET

The Industries and Professions Not Subject to California’s New Independent Contractor Restrictions Effective January 1, 2020, Assembly Bill (AB) 5 will dramatically extend the ultra-strict Dynamex “ABC” test for independent contractor classification. See, California’s Independent Contractors, Endangered Species? (October, 2019). However, a portion of AB-5, to become Labor Code section 2750.3(b), exempts several specific industries/licensed […]

ARE SHOES REIMBURSABLE BUSINESS EXPENSES?

Woman showing ankle, 1908 A California appellate court recently addressed whether BJ’s Restaurants (BJ’s) improperly failed to reimburse its employees for the purchase of slip-resistant shoes. Server Krista Townley sued on behalf of herself and other similarly-affected hourly co-workers alleging BJ’s Restaurants (BJ’s) required them to wear black, slip-resistant, close-toed shoes for safety reasons without […]

UNIONIZING HOME HEALTH CARE

California May Require More Home Aide Disclosures Starting July 1, 2019 The Home Care Organization Consumer Protection Act (HCOCPA), effective January 1, 2016, requires licensing of home care organizations (HCOs) and registration of their home care aides (HCAs). The Home Care Services Bureau (HCSB) of California’s Department of Social Services (CDSS) regulates this industry. See […]

CHECK OR DEBIT CARD

Changes to California’s Mandatory Workplace Pamphlets on State Benefit Programs California employers must provide certain government-issued pamphlets or information sheets to new hires, to employees on certain types of leaves of absence, and to workers upon termination of employment. The California Employment Development Department (EDD) — overseeing unemployment and disability benefits, payroll tax collection, and […]

ALL IN THE FAMILY

New Workplace Notice Available For Family Related Leaves Starting April 1, 2019, covered California employers must post the new Family Care and Medical Leave and Pregnancy Disability Leave notice (DFEH-100-21/March 2019). Previously, the notice was only for employers with 50 or more on payroll. It summarized employee rights and responsibilities when requesting Family Care […]

FOR WHOM THE BELL TOLLS…

KNOCK, KNOCK When It’s Your Turn For a Government Payroll Audit For California, the Employment Development Department (EDD) is responsible for the administration of unemployment and disability insurance, workforce training services and payroll audits. The agency has the power to impose significant, potentially fatal penalties for non-compliance. An EDD visit to look over pay practices […]

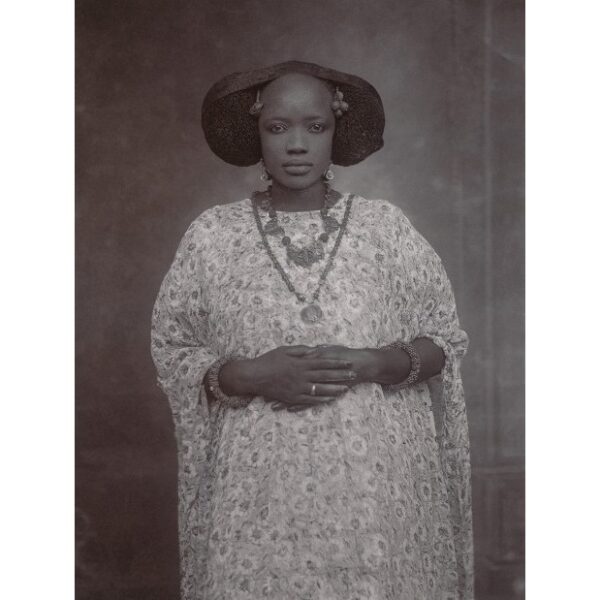

HAIRSTYLE DISCRIMINATION

California Aims to Protect Workers Against Race-Based Natural Hairstyle Bias Federal, state and local laws have long banned workplace racial discrimination. A recent trend seeks to expand such protections to various race-based traits, particularly certain hairstyles. Under California’s now-pending Senate Bill (SB 188), workplace dress or grooming policies prohibiting natural hairstyles, including Afros, braids and […]

E-VERIFY IS BACK FEBRUARY 11, 2019 “CATCH-UP” DEADLINE

The federal E-Verify program provides a way for employers to confirm that people they are hiring are eligible to work in the United States. Participation in E-Verify is discretionary for most employers, but mandatory for federal contractors and certain others, such as businesses in states requiring its use. California is not one of those states. […]