Posts Tagged ‘pasadena employment law attorney’

REQUIRED MEAL PERIODS AND REST BREAKS REVISITED

Off-Duty Time During a California Work Day California employers must provide every not-exempt-from-overtime employee unpaid meal and paid rest breaks based on the number of hours that employee works in a given day. However, the rules vary for such workers as specified in the 17 Industrial Welfare Commission (IWC) Wage Orders covering in different industries […]

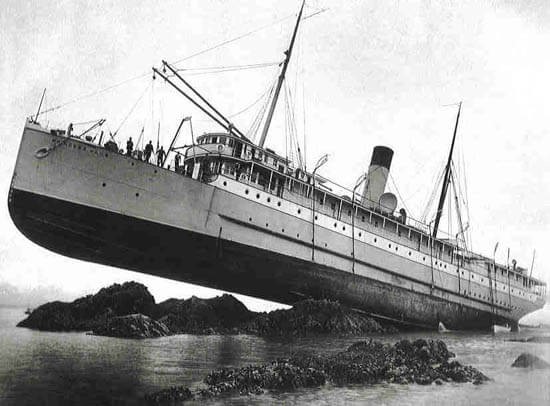

SAFE HARBOR OR SHIPWRECK? PART 2

Department of Labor Has Launched Program For Voluntary Correction of Payroll Errors Last week’s blog, Safe Harbor or Shipwreck?, detailed the U.S. Department of Labor’s (DOL) imminent PAID program (Payroll Audit Independent Determination). The program permits employers to audit their own records for wage compliance violations and to correct those violations in cooperation with the […]

WHY JOB DESCRIPTIONS MATTER

Employers can easily overlook the importance of job descriptions, starting as part of the hiring process. No law requires them and no explicit guidelines or instructions exist for writing them. However, properly written and updated job descriptions can be an important tool to help management and employees fully understand the nature of each company position […]

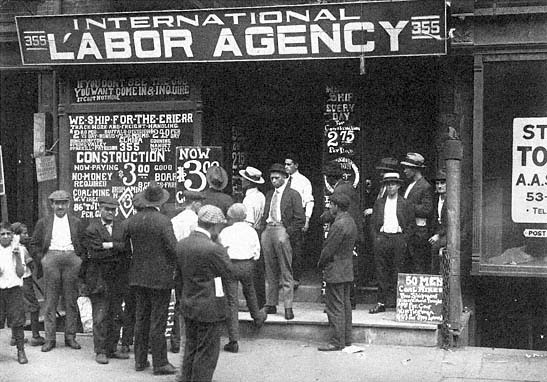

SAFE HARBOR OR SHIPWRECK?

New U.S. Department of Labor Payroll Audit Independent Determination (PAID) Program to Voluntarily Address Payroll Errors The U.S. Department of Labor (DOL) has announced the imminent launch of the PAID program – Payroll Audit Independent Determination. The program’s intent is to permit employers to self-audit and correct as appropriate their minimum wage and overtime practices, […]

THE NEED FOR WRITTEN EMPLOYMENT AGREEMENTS

Well-Drafted Contracts Eliminate Uncertainty and Ambiguity Most workers are employed “at-will,” meaning either the employer or employee may end the work relationship at any time for any lawful reason without cause or advance notice. California law generally presumes an employee is employed at-will unless the employee can prove otherwise, such as a manager’s contrary verbal […]

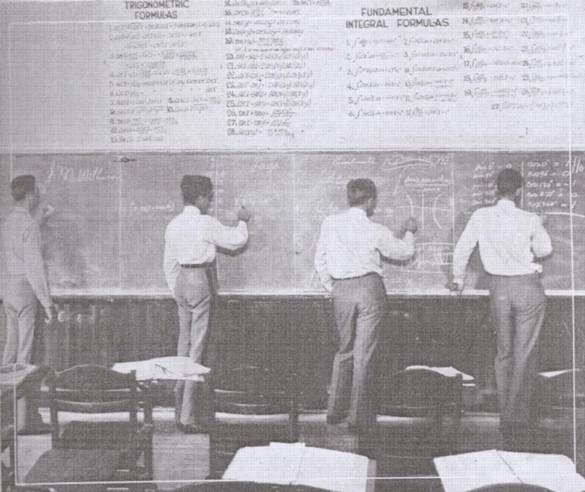

DO THE MATH

California Supreme Court Sets Out New Formula for Overtime When “Flat Sum” Bonuses Paid Often California employers reward employees with bonuses without realizing the proper way to calculate overtime when doing so. This can put an employer at substantial risk if miscalculated over significant time for a large number of workers. Depending on the number […]

CAUTIONARY TALES EPISODE NINE

Weight Loss and Fitness Chain $8.3 Million Lighter After Citations for Wage and Hour Violations The Labor Commissioner’s latest press release announced citations of $8.3 million against Camp Bootcamp, Inc., dba Camp Transformation Center, which operates 15 fitness and weight loss centers from its Chino headquarters. The citations include a long list of Labor Code […]

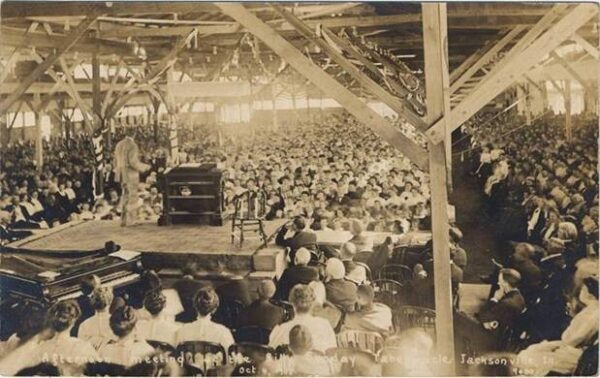

RELIGIOUS OBJECTION TO MANDATORY FINGERPRINTING

Employer Must Properly Address Faith-Based Protest Employers must correctly field and handle an employee’s religiously-based objection to a workplace requirement, even when the employer’s requirement is mandated by law. For example, in Kaite v. Altoona Student Transportation, Inc., plaintiff worked as a Pennsylvania school bus driver for employer Altoona Student Transportation (AST). AST began implementing […]

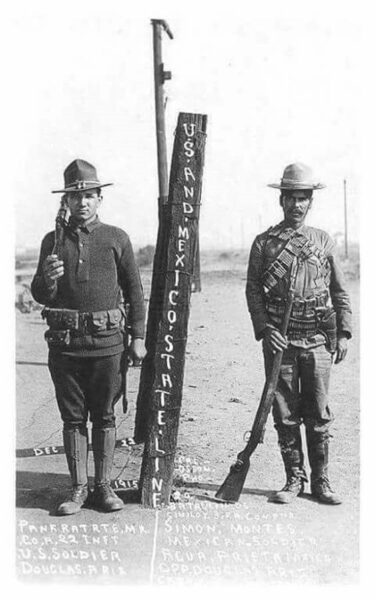

CALIFORNIA VERSUS THE FEDS

California Law Restricts Employer Cooperation with Immigration Agents California’s Immigrant Worker Protection Act, AB 450 (the Act), went into effect on January 1, 2018. It creates numerous restrictions to prevent an employer’s voluntary cooperation with worksite immigration inspections. Pursuant to the Act, Government Codes 7285.1 and 7285.2 prohibit employers from voluntarily allowing access to non-public […]

PAPERLESS PAYSTUBS

Do They Comply with California Wage Statement Laws? As the corporate world heads towards paperless offices, more employers may wish to remit pay stubs electronically without running afoul of applicable law. California Labor Code section 226(a) requires employers to furnish wage statements “in writing” and itemized deductions to be recorded “in ink or other indelible […]